How to Pay for College (without hating your life after graduation)

College debt forgiveness plans are drawing a lot of attention recently.

Wherever you stand on this issue, one thing is certain: student debt isn’t going away tomorrow. If you (or your child) are going to college soon, picking the right school, the right major, and the right way to pay are all challenges you need to solve.

Student debt is a major determining factor of net worth, so you should minimize it as much as possible.

As you know, the most successful people follow processes for almost everything – a college decision is no different.

Rather than crossing your fingers and rolling the dice, here’s a strategy you can use to minimize your student debt and get a job that allows you to repay that debt.

Step 1: Take advantage of AP credits

Many high schools offer advanced placement (AP) courses for students at all grade levels. The AP Program is administered by the College Board and offers 38 courses in seven subject categories.

These courses are beneficial for many reasons:

They are modeled after comparable entry level college courses, so they give students a taste of what to expect in college.

The syllabus is not dictated by a governing body, so teachers have more autonomy to teach how they want to teach, resulting in a better experience for the student.

Taking AP courses demonstrates drive and initiative, so they add a lot of value on a college application.

Passing the AP exam generally means receiving between three and six credits that will transfer into your future college. Every school is different, so use this tool to figure out what your college will accept.

That last bullet is the most important. Why?

The standard AP exam fee for 2019 is $94, which means you could receive up to six college credits for that price. Just for reference, let’s look at the cost of credits at a few different colleges.

One year of college tuition generally covers 30 credits. The following cost per credit is based on annual tuition price at the schools listed:

Harvard: $1,591 per credit, or $9,546 for six credits

Penn State (in state): $615 per credit, or $3,690 for six credits

Duke: $1,940 per credit, or $11,640 for six credits

Ohio State (in state): $358 per credit, or $2,145 for six credits

UNC Chapel Hill (in state): $301 per credit, or $1,806 for six credits

I think you get the point.

Taking one AP class in high school could save you nearly $2,000 on the low end and more than $10,000 on the high end. Sometimes a small change can make a huge difference.

In addition to AP classes, some high schools offer dual enrollment programs. These programs allow high school students to take college courses and earn college credits while still attending high school.

Multiple studies have shown that dual enrollment programs have a significant positive impact on the chances of a student finishing a college degree. The average increase is 25 percentile points.

The other major benefit is the cost: tuition is usually discounted or free. This helps with your bottom line and also provides greater access to students of lower socioeconomic statuses.

How I did it

During my four years in high school, I took four AP classes: US History, World History, Biology, and Calculus.

I (read:my parents) spent about $340 on AP exams during my high school career –they were a little bit cheaper when I was taking them ten years ago.

I attended Utica College, where I received the following credits for my AP classes:

AP Biology: 4 credits

AP US History: 6 credits

AP World History: 3 credits

AP Calculus: 0 credits – Calculus felt like Mandarin to me, so I failed the test.

I entered college with 13 credits already complete – nearly a full semester!

I ended up taking a two-credit online course and graduating one semester early. This knocked about $15,000 off the total price tag for my bachelor’s degree – the cost of one semester of tuition when I was at UC. And that doesn’t account for the cost of books, housing, and meals that accompany tuition.

Step 2: Pick a major that leads to a career

Peter Thiel put it best when he said:

“It doesn’t matter what you do as long as you do it well. That is completely false. It does matter what you do. You should focus relentlessly at something you’re good at doing, but before that you must think hard about whether it will be valuable in the future.”

You might be great at drawing. You might love history. You might be passionate about environmental science.

You could incur six figures of debt to get a degree in one of those fields. You might get a job, and you might love that job. But putting all your eggs in that basket is a major roll of the dice.

I get that college isn’t solely about landing a job. It’s about understanding culture, gaining perspective, becoming independent, and growing as a person. But all those qualities contribute to the end goal – being an employable human with a desirable skill set.

College is a means to an end. That end needs to justify the means.

Deciding what you want to be when you grow up is a daunting task for most people, let alone an 18 year old with limited life experience.

With that in mind, don’t try to tackle the question all at once. The best way to eat an elephant is one bite at a time.

First, figure out what you like and are good at.

Then do some research to find jobs that fit those skill sets.

Next, research the jobs to find out what they involve (this is a great resource), where they are based, if there are many openings, and what they pay.

Repeat this process until you find something you can see yourself doing – something that pays more than two movie vouchers and a packet of crackers every other week.

Here are a couple examples of what that process might look like:

I enjoy helping people, and I do well in biology class. Google is telling me those two qualities are common for nurses. It looks like nurses can work pretty much anywhere – urban or rural, busy hospital or quiet doctor’s office. And according to The Bureau of Labor Statistics, the median annual pay was about $72,000 in 2018, and job openings are growing much faster than average – not bad! More specifically, I want to live in Idaho, so let me check the Georgetown Economic Value of College Majors tool – looks like the median salary for nurses in Idaho is a bit below the national average, but still pretty good.

I have a shy personality and enjoy working on projects by myself. I also spend a lot of time on the computer, and I like figuring out how to make shortcuts for things I do every day. After a little research, it seems like I might be well suited for a job in computer science or programming. According to the Bureau of Labor Statistics, the median annual pay for a software developer in 2018 was $106k! It also looks like the job outlook is great – a 24% employment increase by 2026.

One way to counteract that black hole of doom is to ask yourself some tough questions and put in your time doing research. Don’t throw a Hail Mary and think it’ll work itself out later – cause it won’t.

Everyone talks about the fact that college graduates make about $1 million more than non-college grads over the course of a career. What people don’t talk about – and is more significant – is that picking a high paying major results in three times the career earnings of picking a low paying major.

Source:

The Economic Value of College Majors

- Georgetown University

If you major in underwater basket weaving with a minor in harmonica composition, you deserve to spend the remainder of your life under soul crushing debt.

What if I'm not sure about college?

If you’re not sure, don’t default to college. It’s far too expensive as a form of experimentation.

As a cheaper and sometimes better alternative, consider these options:

Lambda School – This is an online, nine month program that teaches students to code. They have several flexible payment options, including one with no money down and no repayment until you make $50k annually.

Lineman School– If you like working outside, and you don’t want to devote four years to college, lineman school might be for you. It lasts about 15 weeks, costs about $16,000, and the median annual salary is about $71,000.

Military – Learn discipline, earn a pay check, mature over four years, receive tuition assistance. This option isn’t for everyone, but it prevents you from going into debt to follow an uncertain path.

These are just a few of many potential alternatives.

I’m not telling you not to go to college. I’m just saying you should think about it. There are other options.

How I did it

I wanted to be a cop. I knew all I needed was a two-year degree. And most of the reason for that was to kill two years until I was old enough to enter a police academy.

My parents were determined to convince me I needed a bachelor’s degree, so my mom did many hours of research and eventually sold me on it.

What she found was a program called Economic Crime Investigation. This was a bachelor’s degree offered by Utica College as part of their criminal justice program (today the program is called Fraud and Financial Crime Investigation).

It was a criminal justice degree, so it appealed to my I’m going to be a cop mentality. But it also offered classes on banking, payment systems, fraud, investigative techniques, and money laundering.

The selling point for me was high job placement rates – over 90% for graduates willing to relocate. This was due in part to the professional connections of the faculty, many of whom had worked in law enforcement or financial crime compliance.

All the credit is due to my parents for this good decision, but it’s a process that is repeatable by you or for your kids.

As a result, I graduated with a marketable skill set and a full-time job. I was 21 years old with an annual salary of $63,000 – not bad!

Step 3: Shop around - college is one of the biggest purchases you will ever make

Smart people don’t buy a car on their first day shopping at the first dealership without doing any research.

You wouldn’t buy a new set of golf clubs without reading reviews, hitting some different brands, and shopping around for the best price.

You don’t pick a random vacation spot without recommendations from friends, researching the destination, or scoping out the cost of flights.

All those things cost less than college, so you’re a fool if you spend less time on your college decision.

Leverage your offers

Once you decide what major you want to pursue, you need to find which colleges offer that major in your desired geographic location.

Do some Google searches, find as many colleges as possible, visit as many as you can, and apply to all of them – even the ones you don’t want to attend.Let’s pause for a second to answer a couple questions:

If I’m trying to cut costs, should I only apply for public schools? The short answer is no. The long answer is that many private colleges have large endowments, so even though the sticker price is higher than a public school, your bottom line might end up being lower after scholarships and grants (it was for me).

Why would I apply to a school I don’t want to attend? Many colleges will waive the application fee if you visit the campus. An acceptance and large financial award from a school you don’t want to attend is a perfect bargaining chip. You can take it to your top choice school and say, “I would rather come here, but XYZ University is giving me twice as much scholarship money. What can you do for me?” This is a technique I used to receive an extra $2,500 in grants per semester.

Find your advocate

If you’re a student athlete, coaches may recruit you and act as your advocate in the financial aid department. If you don’t plan to play college sports, you need to find a different advocate – I suggest a professor in your desired major.

Browse the college’s website, specifically looking for professors in your major. Then send out some emails asking if they are available to have lunch or coffee when you visit the campus. This shows initiative and could create a valuable relationship with someone who pulls weight at the school.

If you get a coffee meeting, don’t show up like an unprepared schmuck. Come with questions – maybe something like:

“Do you recommend reading any books or articles before I get to campus?”

“Where are some of your recent graduates working?”

“What are the biggest unexpected challenges for students in this program?”

This is easy prep work, and it makes you look good. Professors want students who are engaged and take initiative because it reflects positively on their program. Make a good first impression, and it might help your financial outlook.

Don't let the frills cloud your decision

There’s a good chance you’ll visit a school you fall in love with. The campus is perfect, the dorm rooms are beautiful, the cafeteria food is closer to Red Lobster than Bo Jangles, and it is just the right distance from home. There’s only one catch – instead of $5,000 per semester, it will cost you $20,000.

It’s important to feel comfortable in the place where you’re about to spend four years. But if the difference between like and love is the difference between $40,000 of student debt and $160,000 of student debt, you’re a god damned fool to pick the place you love.

Making the wrong decision in that scenario is the most short sighted, financially destructive decision you can make.Either scenario will likely lead to a similar job outcome with a similar salary, but the second choice will result in MAJOR sacrifices later in life. You might have to postpone buying a house, getting married, having kids, and even retiring. That decision will severely limit your future freedom. Don’t compromise long term options for temporary happiness.

Here’s a good rule of thumb: don’t finish school with student debt that exceeds about half your likely annual starting salary.

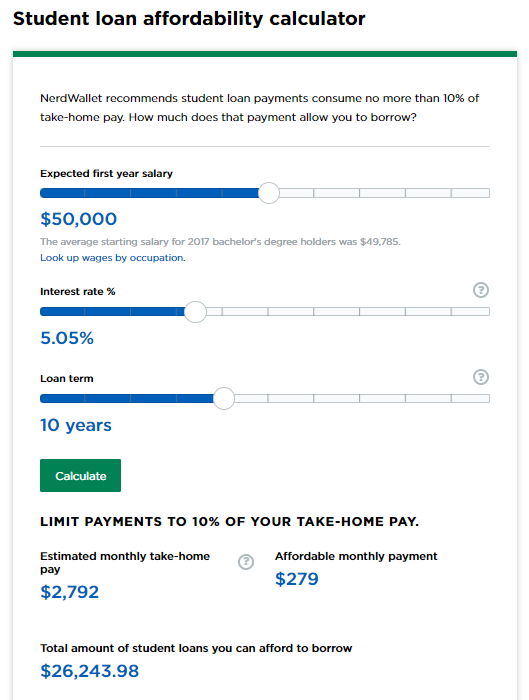

According to NerdWallet, you don’t want your monthly student loan payment to exceed 10% of your take home pay. They have an easy to use calculator that demonstrates what you can afford to borrow based on this 10% rule. Here’s an example:

Source:

If you choose to ignore the 10% rule, here’s another (much scarier) scenario.

According to The White Coat Investor, if you want to repay your student loans within five years, assuming a 7% interest rate, these are the percentages of your gross income you will need to contribute if your student debt is:

1X annual income: 24% - This seems high,but I can manage.

2X annual income: 48% - This is tough. I won’t be taking any vacations, or saving any money, or ever going out to eat

3X annual income: 72% - This is damn near impossible. I’ll have to live with my parents, and I’ll probably have to work a second job.

4X annual income: 96% - Fuck me. I should’ve skipped college and joined the circus.

How I did it

Who cares how I did it – my sister’s story is much better than mine.

Autumn picked the school she liked over the school she loved. Why? Because it was a better financial decision.

She majored in nursing and was accepted to a couple different programs. The first was a private school with a great nursing program. They offered her a decent scholarship – it covered about half the costs, leaving her with an obligation of around $20,000 per year.

School number two was a state college with a good nursing program. They offered her a scholarship with a similar dollar amount, but the difference was that it was a full ride at school number two.After all the chips fell, she would owe around $1,000 per year for various fees and dorm room upgrades.

She wasn’t in love with school number two.It wasn’t her first choice. But the financial implications of the decision were too big to ignore.

Also, a nursing degree is nursing degree, no matter where it’s from. There was no noticeable difference in starting salary, only a noticeable difference in future net worth.

Choosing school number two meant she would graduate with $0 in student debt.

Choosing school number one meant she would graduate with $20k - $30k in debt (after help from our parents).

Autumn graduated college last month. S he graduated from school number two with no student debt and a signed job offer.She starts next month and will be able to quickly build her net worth, rather than spending years trying to get it back to $0.

While school number two wasn’t her first choice, she still loved her time at college. She made tons of friends, got a good education, and set herself up for financial success.

The bottom line

As I mentioned before, I graduated college at 21 and walked directly into a job with a $63,000 annual salary.

I also graduated with $8,000 in student debt – all of which were federally subsidized loans. I paid those loans off in six months and paid exactly $0 in interest.

I can’t pretend I picked myself up by the bootstraps. I was very fortunate to receive about $24,000 and priceless guidance from my parents.

I had at least $10,000 more in gifts from grandparents saved over 18 years.

You can call it good fortune, you can call it white privilege. But here’s something you can’t dispute:

The sticker price on my four-year degree was about $160,000. The total out of pocket cost to me and my family was about $48,000. AND I graduated with a good paying job.

I did it by:

Taking advantage of AP credits in high school, so I could graduate college early.

Working my ass off in high school to receive academic scholarships.

Picking a major with a definite career path, even though it wasn’t EXACTLY what I wanted to do.

Applying to multiple schools and leveraging the offers against each other.

Living off campus for one of three years (significantly cuts housing and food costs).

Working – full time in the summers, work study on campus, delivering pizzas off campus.

I’m not promising this is the solution to the student debt crisis.

But if you implement this system, you’ll be much better off than someone who doesn’t. You will graduate with less student debt and a higher paying job. You’ll also be on a better path to a higher net worth at a younger age – which is the key to freedom.

My plan isn’t far-fetched, it’s in your control, and it’s proven to deliver results. The next step is up to you.